最近狗哥为了挣钱,专研了一阵股票基金投资策略。虽然之前也有投资,但都是随缘。正好网站前景几乎没有了,并且大部分时间都被小孩占用,只能将所剩不多的精力投入另一种爱好中。

均线又称快速移动平均线,根据不同周期计算出来的有不同的名字,大家熟知的有5日均线,10日均线等等,均线反映了周期内价格波动变化,一定程度上指示了当今价格是否值得投资。定投很好理解,就是在周期内固定投入,结合均线得到均线定投策略。

下面是本次回测使用的具体均线定投策略

复制

# 定投倍数与均线关系的参数

discount_params = [

{'threshold': 0.875, 'discount': 4}, # 低于均线12.5%,投入4倍定投金额

{'threshold': 0.9, 'discount': 3.75}, # 低于均线10%,投入3.75倍定投金额

{'threshold': 0.925, 'discount': 3.5}, # 低于均线7.5%,投入3.5倍定投金额

{'threshold': 0.95, 'discount': 3}, # 低于均线5%,投入3倍定投金额

{'threshold': 0.975, 'discount': 2}, # 低于均线2.5%,投入2倍定投金额

{'threshold': 1.0, 'discount': 1.0}, # 高于均线0%,投入1倍定投金额

{'threshold': 1.05, 'discount': 0.8}, # 高于均线5%,投入0.8倍定投金额

{'threshold': 1.1, 'discount': 0.6}, # 高于均线10%,投入0.6倍定投金额

{'threshold': 1.2, 'discount': 0.5}, # 高于均线20%,投入0.5倍定投金额

{'threshold': 1.3, 'discount': 0.4}, # 高于均线30%,投入0.4倍定投金额

{'threshold': 2, 'discount': 0}, # 高于均线200%,不投

]另外,为了增强对波动的抵抗,即降低回测,设置止盈,每次收益达到5%就卖掉一半仓位。

详细代码如下

复制

import baostock as bs

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from datetime import datetime

import matplotlib.dates as mdates

d = 30

mv = "ma" + str(d)

# 登录baostock

lg = bs.login()

if lg.error_code != '0':

print("登录失败:" + lg.error_msg)

exit()

# 获取沪深300指数的日K数据

hs300_code = "sh.000300"

start_date = "2020-01-01"

end_date = "2025-05-31"

rs = bs.query_history_k_data_plus(hs300_code,

"date,code,close",

start_date=start_date, end_date=end_date,

frequency="d", adjustflag="3")

if rs.error_code != '0':

print("获取数据失败:" + rs.error_msg)

exit()

# 将数据转换为DataFrame

data = rs.get_data()

data['date'] = pd.to_datetime(data['date'])

data = data.set_index('date')

data['close'] = data['close'].astype(float)

# 计算均线

data[mv] = data['close'].rolling(window=d).mean()

# 定投倍数与均线关系的参数

discount_params = [

{'threshold': 0.875, 'discount': 4}, # 低于均线12.5%,投入4倍定投金额

{'threshold': 0.9, 'discount': 3.75}, # 低于均线10%,投入3.75倍定投金额

{'threshold': 0.925, 'discount': 3.5}, # 低于均线7.5%,投入3.5倍定投金额

{'threshold': 0.95, 'discount': 3}, # 低于均线5%,投入3倍定投金额

{'threshold': 0.975, 'discount': 2}, # 低于均线2.5%,投入2倍定投金额

{'threshold': 1.0, 'discount': 1.0}, # 高于均线0%,投入1倍定投金额

{'threshold': 1.05, 'discount': 0.8}, # 高于均线5%,投入0.8倍定投金额

{'threshold': 1.1, 'discount': 0.6}, # 高于均线10%,投入0.6倍定投金额

{'threshold': 1.2, 'discount': 0.5}, # 高于均线20%,投入0.5倍定投金额

{'threshold': 1.3, 'discount': 0.4}, # 高于均线30%,投入0.4倍定投金额

{'threshold': 2, 'discount': 0}, # 高于均线200%,不投

]

# 初始化定投金额和持仓信息

total_investment = 0

total_shares = 0

total_shell = 0

monthly_investment_base = 1000 # 基础每月定投金额

target_profit_rate = 0.05 # 目标收益率

sell_ratio = 0.5 # 卖出比例

last_sell_price = None # 上一次卖出价格

last_sell_month = None # 上一次卖出的月份

last_sell_year = None # 上一次卖出的年份

# 模拟月定投

investment_records = []

last_month = None

return_rates = [] # 用于存储每个时间点的收益率

for date, row in data.iterrows():

current_year = date.year

current_month = date.month

current_day = date.day

if last_month is None or current_month != last_month or current_day == 1:

last_month = current_month

#定投

discount = 1.0

for param in discount_params:

if row['close'] < row[mv] * param['threshold']:

discount = param['discount']

break

dynamic_investment = monthly_investment_base * discount

total_investment += dynamic_investment

total_shares += dynamic_investment / row['close']

investment_records.append((date, dynamic_investment, 'buy'))

# 检查是否达到目标收益率

current_value = total_shares * row['close']

if total_investment > 0:

rate=(current_value -(total_investment-total_shell) ) / (total_investment)

else:

rate = 0

if total_investment > 0 and rate >= target_profit_rate:

#卖出

sell_shares = total_shares * sell_ratio

total_shares -= sell_shares

sell_amount = sell_shares * row['close']

total_shell += sell_amount

investment_records.append((date, -sell_amount, 'sell'))

last_sell_price = row['close']

last_sell_month = current_month

last_sell_year = current_year

# 计算当前收益率

current_return_rate = ((total_shares * row['close'] + total_shell) - total_investment) / total_investment * 100

return_rates.append((date, current_return_rate))

# 计算最终持仓价值

final_value = total_shares * data.iloc[-1]['close']

# 打印结果

print(f"总定投资金: {total_investment}")

print(f"总持仓股数: {total_shares}")

print(f"最终持仓价值: {final_value}")

print(f"收益率: {(((final_value + total_shell) - total_investment) / total_investment) * 100:.2f}%")

# 设置中文字体

plt.rcParams['font.sans-serif'] = ['SimHei'] # 使用黑体

plt.rcParams['axes.unicode_minus'] = False # 正确显示负号

# 绘制图表

fig, ax1 = plt.subplots(figsize=(14, 7))

# 绘制沪深300指数和均线

ax1.plot(data.index, data['close'], label='沪深300指数')

ax1.plot(data.index, data[mv], label=mv, color='blue')

ax1.set_xlabel('日期')

ax1.set_ylabel('收盘价')

ax1.legend(loc='upper left')

# 创建共享x轴的第二个坐标轴

ax2 = ax1.twinx()

ax2.set_ylabel('收益率')

# 绘制收益率曲线

return_rate_dates = [mdates.date2num(date) for date, _ in return_rates]

return_rates_values = [rate for _, rate in return_rates]

ax2.plot(return_rate_dates, return_rates_values, label='收益率曲线', color='orange')

ax2.legend(loc='upper right')

# 转换datetime为matplotlib的日期格式

dates = [mdates.date2num(date) for date, _, _ in investment_records]

closes = [data.loc[date, 'close'] for date, _, _ in investment_records]

investments = [investment for _, investment, _ in investment_records]

types = [typ for _, _, typ in investment_records]

# 绘制定投点和卖点

buy_dates = [date for date, investment, typ in investment_records if typ == 'buy']

buy_closes = [data.loc[date, 'close'] for date, investment, typ in investment_records if typ == 'buy']

buy_investments = [investment for date, investment, typ in investment_records if typ == 'buy']

sell_dates = [date for date, investment, typ in investment_records if typ == 'sell' or typ == 'additional_sell']

sell_closes = [data.loc[date, 'close'] for date, investment, typ in investment_records if typ == 'sell' or typ == 'additional_sell']

sell_investments = [investment for date, investment, typ in investment_records if typ == 'sell' or typ == 'additional_sell']

ax1.scatter(buy_dates, buy_closes, color='green', label='买入点')

ax1.scatter(sell_dates, sell_closes, color='red', label='卖点')

# 在每个买入点和卖点添加文本标签

for date, investment in zip(buy_dates, buy_investments):

ax1.annotate(f'{investment:.2f}', (date, buy_closes[buy_dates.index(date)]), textcoords="offset points", xytext=(0,10), ha='center', color='green')

for date, investment in zip(sell_dates, sell_investments):

ax1.annotate(f'{investment:.2f}', (date, sell_closes[sell_dates.index(date)]), textcoords="offset points", xytext=(0,-15), ha='center', color='red')

# 设置日期格式

ax1.xaxis.set_major_formatter(mdates.DateFormatter('%Y-%m-%d'))

ax1.xaxis.set_major_locator(mdates.AutoDateLocator())

# 在图表上添加总投入和收益率

ax1.text(data.index[-1], data['close'].max(), f'总定投资金: {total_investment:.2f}\n最终持仓:{final_value:.2f}\n套现:{total_shell:.2f}\n收益:{((final_value + total_shell) - total_investment):.2f}\n收益率: {(((final_value + total_shell) - total_investment) / total_investment) * 100:.2f}%', ha='right', va='top', fontsize=10, color='blue')

plt.title(f'沪深300指数与{d}日均线')

plt.grid(True)

plt.show()

# 登出baostock

bs.logout()

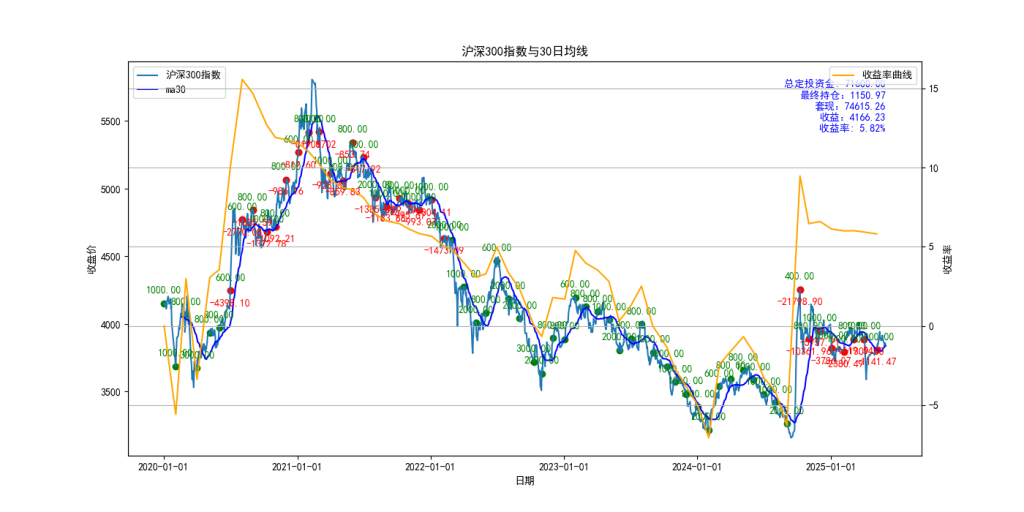

上面的代码演示了,使用30日均线作为投资参考,2020-01-01到2025-05-31,每月第一个交易日,定投1000元,沪深三百的均线定投回测效果,最终的效果如下

复制

总定投资金: 71600.0

总持仓股数: 0.2997135690443538

最终持仓价值: 1150.9697285924076

收益率: 5.82%整个程序使用了baostock提供数据,pandas为数据提供标准格式,便于分析,matplotlib用来绘制图表(如图一),如果不需要图表可以不要它。

注意:本文仅对过往数据进行测试研究,不做任何投资建议!

评论 (0)